Yes, Petrochemicals are part of the answer – Business Case

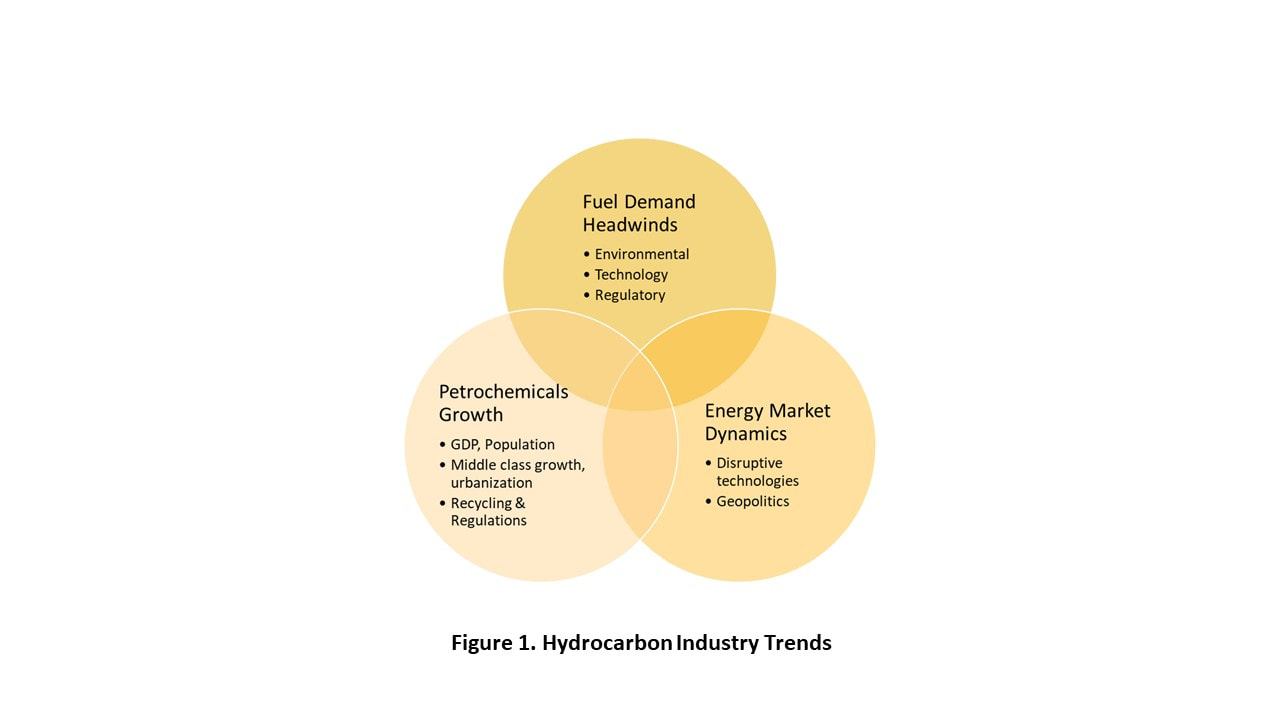

Figure 1 highlights some of the current industry trends that are shaping the future. Fuel demand, particularly in the transportation sector, is facing environmental pressure due to climate change (including greenhouse gas emissions) and air quality in large urban centers. Electrification of vehicles, sharing platforms (like Uber, etc.), and disruptive technologies/models for supply chains including commercial transportation (mainly trucks and freight carriers) will impact fuel demand significantly in coming years. The regulatory environment is evolving quickly to limit emission levels related to sulfur and other components as well as requiring electrification of transportation systems and higher contribution of renewable/alternate energy sources. These forces will result in a slowdown in fuel demand in the coming years.

The energy market has always been very dynamic over the last 50 years driven mostly by geopolitics along with demand growth in developing economies. The last decade has seen disruptive technologies, particularly shale, playing a much larger role in shaping the energy market. These resulted in higher market volatility. Geopolitics has been further complicated by sanctions regime and threats of trade barriers/tariffs. Countries around the world are rethinking their energy security and options to lower current threats and risks.

Hydrocarbon demand for the petrochemical industry is expected to grow at much higher levels as compared to energy demand. Petrochemicals demand is closely tied to the growth of GDP and population growth. It’s driven primarily by the growing middle class in emerging economies and a larger shift of population to urban centers. Petrochemical growth will see some negative impacts due to changes in the regulatory environment (e.g. ban on single-use plastics) and a greater emphasis as well as environmental pressure for increased plastic recovery and recycling. Overall petrochemical products contribute tremendously to improving quality of life and as a larger percentage of the population in developing economies move into the middle class, we will see continued growth in demand.

It’s no surprise that refineries are now looking at higher levels of petrochemical integration as a prudent diversification strategy for future sustainable growth. This is evident from some of the complexes that are currently in engineering and construction or in the early stages of development. Some of the recent announcements include:

- Saudi Aramco and SABIC JV for Crude Oil to Chemicals (COTC)

- Ratnagiri integrated Refinery and Petrochemical Complex (likely JV of 3 Indian Oil Companies, Saudi Aramco and ADNOC)

- DUQM Refinery and Petrochemical Integrated Project

- ADNOC Mixed Feed Cracker integrated with Refinery

- TOTAL, Saudi Aramco JV SATORP Mixed Feed Cracker integrated with the refinery

- 5 (or more) major Refinery-Petrochemicals integrated projects in China announced in the last 2 years

- Petronas and Saudi Aramco JV Refinery and Petrochemical integrated development (RAPID project)

I will touch some more on refinery-petrochemical integration in the future. Please feel free to contact me at [email protected]

RSS Feed

RSS Feed